A suspicious transaction system based on outdated scenarios can lead to damage to corporate reputation and severe financial sanctions. Compliance penalties imposed on international banks in recent years have once again demonstrated the importance of having a robust AML compliance system in place.

So, do not take any risk in reviewing and implementing AML scenarios and use qualified AML experts for efficient algorithms who have organizational knowledge and also have professional experience and field knowledge.

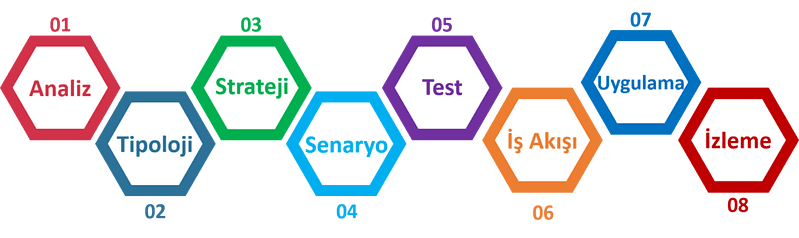

Following AMLTHINK's risk-based approach will increase the effectiveness of your AML rules and scenarios, and you will be confident in defining all scenarios covered by global and local regulations.

We help you increase the efficiency of your compliance unit by implementing appropriate risk-based scenarios.

Our practice and experience-based data analysis helps you determine or adjust your thresholds based on risk.

We enable you to evaluate gaps in your current transaction monitoring practices and processes and integrate you into the current and potential future technology environment.

Your AML scenarios will be under AMLTHINK System Assurance. If you have any problems, you can contact AMLTHINK for support.